Chancellor Rachel Reeves delivered a highly anticipated Budget announcement yesterday, marking the Labour party’s first fiscal statement in 15 years. With significant increases in spending and substantial tax hikes, this Budget is being hailed as historic. While it contains the largest tax-raising measures since 1993, it also outlines major investments aimed at stimulating economic growth in the UK.

Mixed Reactions in the Property Market

The property market has been buzzing with speculation regarding potential tax hikes and the expected support for the rental sector. Under previous Conservative leadership, landlords faced increased costs from changes in stamp duty and mortgage interest relief, leading many to call for substantial reforms to invigorate the sector.

In the end, the 2024 Budget yielded a mixed bag for the property market. Reeves confirmed her commitment to invest in housing, with a £5 billion allocation for housebuilding in 2025/2026, alongside a renewed emphasis on energy efficiency in homes. However, the Budget also introduced an increase in stamp duty for second homeowners and property investors, raising the surcharge from 3% to 5%.

Capital Gains Tax and Inheritance Tax

Fortunately, the capital gains tax for property disposals remains unchanged, bringing relief to many in the property sector. However, the inheritance tax threshold has been frozen until 2030, extending the previous freeze introduced by the Conservatives. This move means that more individuals may face inheritance tax bills, but there are strategies available for property investors to mitigate these impacts.

Industry Perspectives

Reactions from industry experts have varied, with some welcoming aspects of the Budget while others express disappointment over certain changes. Nicky Stevenson, Managing Director at Fine & Country, noted the mixed outlook for the property market. She commented, “We had hoped to avoid increases in property-related taxes that could slow market growth. The upcoming rise in capital gains tax forces landlords to make critical decisions about their properties. Fortunately, homeowners have been spared from this increase.”

Stevenson added, “The rise in the stamp duty surcharge will likely reshape the decision-making processes for current and prospective sellers, particularly those with multiple properties.” The introduction of the non-dom tax regime’s abolition will also lead to significant changes in the property landscape, potentially reducing demand for high-end properties favoured by foreign investors.

Paresh Raja, CEO of Market Financial Solutions, emphasised the need for clarity in the market, stating, “The Government had warned of tax rises to fill the black hole in public finances, which caused apprehension across the property sector. While the increase in stamp duty was unexpected, the overall steady fiscal approach should help maintain the positive momentum in the property market.”

Challenges and Opportunities

The decision not to raise capital gains tax on residential properties is expected to impact the second home market, as owners are now less inclined to sell. This could create challenges for house hunters hoping for increased inventory in the market. Adam Jennings, Head of Lettings at Chestertons, predicted fewer landlords would opt to sell, while demand for rental properties continues to outstrip supply, keeping rental prices steady.

On the other hand, first-time buyers are expressing disappointment as the Budget did not retain the £425,000 stamp duty threshold for first-time buyers, which will now revert to previous levels. This change is likely to make it more challenging for aspiring homeowners to enter the market, particularly in higher-priced areas like London.

Looking Ahead

In summary, the 2024 Budget presents a mixed outlook for the property market. While it promises significant investment in housing and maintains capital gains tax rates for residential properties, the increase in stamp duty for second homes could hinder investment in the rental sector.

As the market adjusts to these changes, collaboration among lenders, brokers, and agents will be crucial in navigating the evolving landscape. The property sector has shown resilience, and with strategic approaches, it can continue to thrive amidst these new challenges.

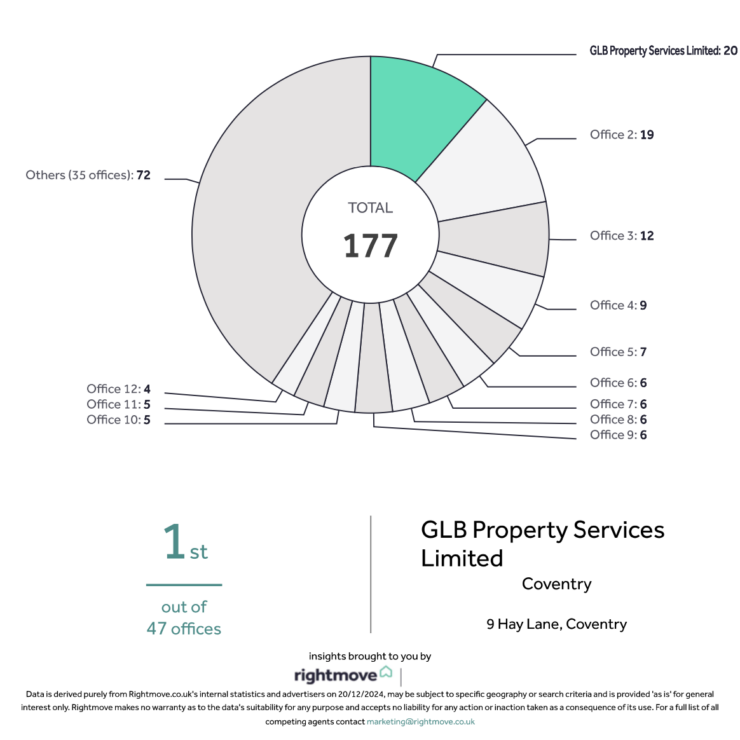

For those looking to make informed decisions about buying, selling, or renting, staying updated with market trends and seeking guidance from trusted professionals like GLB Property Services will be essential in this changing environment.